10:10 – Barbara took off this morning on a trip to Pigeon Forge, Tennessee with her parents, sister, and sister’s husband. They plan to spend several days going to shows and shopping at the outlet malls. They rented a Toyota handicapped-accessible van to make it easier to handle Barbara’s dad’s wheelchair. They’ll be back Sunday. I told Barbara I’d watch 20 or 30 episodes of Despicable Housewives while she’s gone and then tell her what happened when she gets back. The truth is, I probably won’t turn on the TV while she’s gone. I’ll work during the days and read during the evenings. Well, read and throw the ball for Colin. Over and over and over.

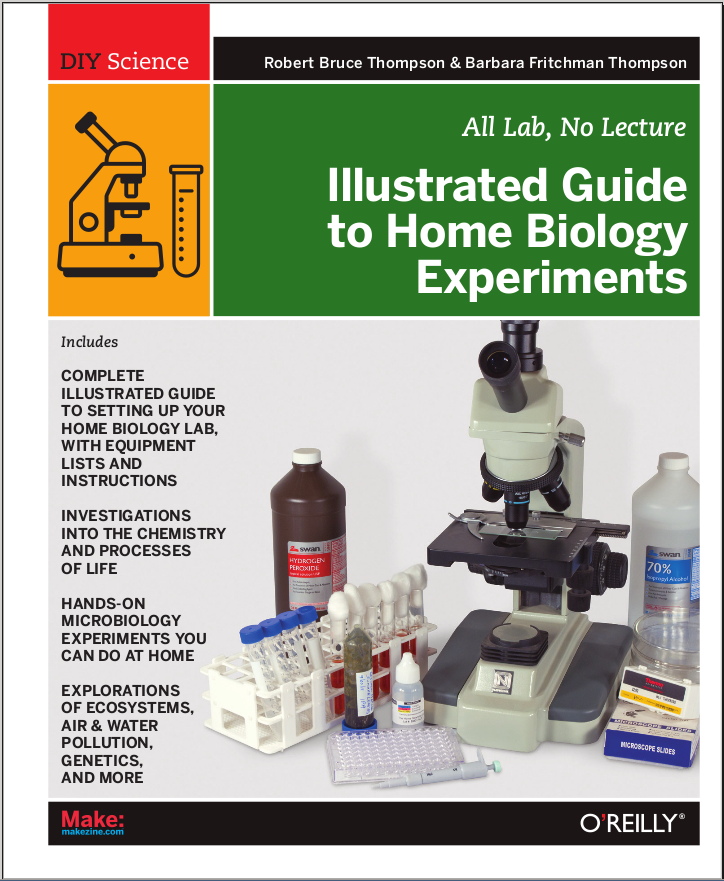

I’m still working heads-down on the biology book. I sent the protists chapter to my editor this morning, and am currently working on a chapter about fungi and lichens.

Meanwhile, during the last couple of weeks, the euro crisis has gone from desperate to catastrophic. Italy and now Spain are on the verge of needing bailouts to avoid defaults, and there’s no money there to bail them out. Belgium isn’t far behind, and France maintains its AAA rating in name only. The FANG nations are now the G nation, with Finland, Austria, and the Netherlands coming under the gun. The ECB has reached and passed its limit in terms of its willingness to buy Italian and Spanish bonds, and without that subsidy Italian and Spanish bond yields will skyrocket from their already-catastrophic 7% levels. Private investors are no longer willing to risk their money in sovereign bonds or private bonds from any EU country other than Germany, and they’ve begun to be leery even of German bunds. The IMF and the BRIC nations have basically told the EU that it’s on its own and it can’t expect any IMF/BRIC bailouts. The US has tossed diplomacy aside, told the EU not to expect any financial support from the US, and is now ordering the EU in no uncertain terms to DO SOMETHING. The trouble is, there’s really nothing to be done, and even if there were, Germany is not willing to pay for it. We’re watching the collapse of the eurozone and the EU itself, and the timeframe is now weeks rather than months. This is not going to be pretty.

13:42 – Oh, my. Forget what I just said about Germany being the last FANG nation left standing. Germany–Germany!–just suffered a failed bond auction. Germany offered €6 billion worth of bonds, but private investors were willing to buy only about 60% of them, leaving the central bank having to buy the rest. Granted, the interest rates were low, at about 2%, but even so. This was the worst auction of German bonds in the euro era. At this point, it’s clear that investors don’t want even German bunds, perceiving (correctly) that Germany is in deep, deep trouble.

14:38 – Actually, I think I will watch something while Barbara is away. We started watching the BBC series, Survivors, on Netflix streaming a couple of months ago, but we watched only the first episode. Barbara found it grim and depressing, and I could tell she really didn’t want to watch any more of it. But it’s still in our queue, and I should be able to get through the remaining 11 50-minute episodes while she’s away.

15:46 – Ah, I wondered how long it would be before this shoe dropped. After watching the concessions given to Greece, it was only a question of time before other bailed out nations demanded that kind of favorable treatment retroactively. The only thing I wasn’t sure of was whether it’d be Portugal or Ireland first. Well, it turns out to be Ireland. Can Portugal be far behind?